This product specially designed to explore the world and take all the benefits while you are going to travel. As we know travel is the best way to explore yourself as much as you want. American express platinum travel credit card not only solve your money issue but also give you discount privileges such as dining while traveling.

It’s a bumper offer for frequent filer or traveler because it allows you to explore every moment of life without any trouble. Let’s find the highlighted points which can describe you more about AMEX travel product.

- For every Rs 50 spent except on insurance, fuel, and cash transactions then get one membership reward points

- You can get 5,000 milestone bonus membership rewards points as a welcome gift

- When every year you have spent Rs 1.90 lakhs via the card, then get travel vouchers over Rs 7,700

- You are avail on travel bookings with MakeMyTrip site

- You can buy any favorite product and payback as installments

- You have to pay joining fee Rs 3,500 with applicable GST

- Annual fee Rs 5,000 with applicable GST

What Are The Requirements Of A AMEX Platinum Credit Card?

When you think about a requirement, so what would come to your mind? Age eligibility and KYC factor. Yes before you can apply have to check online eligibility. According to bank’s norm, you should be 18 years with a spotless credit history.

If we talk about KYC factor, you should deposit identity proof, address proof, income proof, and recent passport size photograph.

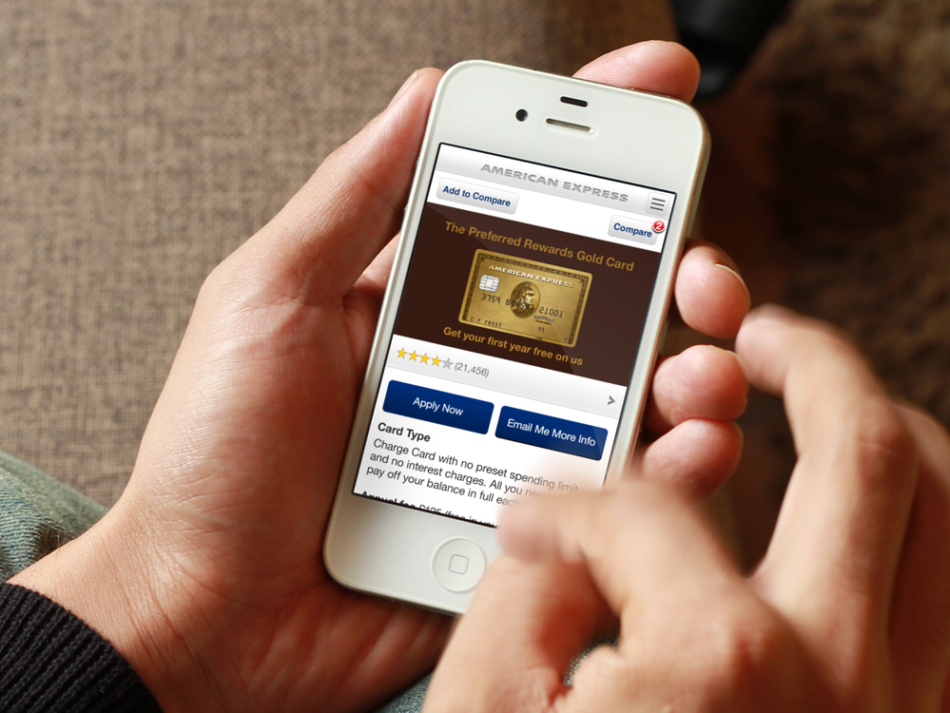

How Can You Apply For AMEX Platinum Travel Card?

If you are a travel lover and want to apply for an American express platinum travel credit card, then it’s a great choice. They are giving you both options as per your comfort level an online and offline. For an online procedure, you have to visit the website page. Fill your personal and professional information, upload KYC, registered email ID and mobile number then submit it. If all shared information would correct, then within 2 to 3 weeks you can receive your product.

For an offline, you have to visit the nearest bank branch and fill the application form with KYC and submit it to the counter.

How Can You Utilise For Payment?

You can use your product for a various way for shopping, traveling and more way but do you know you make payment also? The bank can provide you net banking, autopay, NEFT and more services for online. For an offline, you have two options by cash and cheque.

What Is A Statement Credit?

It’s a positive report of your credit. If you accidentally overspend one month, this can help you to share your report, and you try to control it. The bank statement is provided one-month billing cycle with you. Through this, you can view expenses, limit, cashback and rest things.

For your all queries the American express card can provide you customer care helpline. To get a toll-free number, you have to visit the website. The executives are happy to help you by 24*7 service.