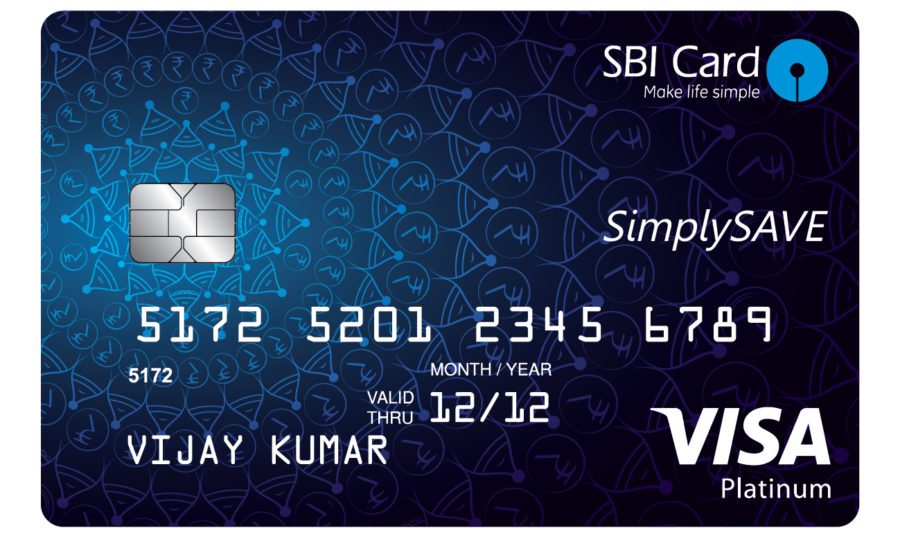

The state bank of India offers various products as per your requirements. You can use your SimplySAVE SBI credit card for more shopping, dining with family, roaming the world with travel benefits, and explore the whole thing as per your wish. You can also earn reward points, cashback, vouchers, and more advantages. Let’s find out benefits of this product, which can fulfill your needs.

Attractive Features Of SimplySAVE SBI Credit Card

- Every Rs 100 spent on dining, movies, departmental stores, grocery spends, and have 10* Reward points

- On spends of Rs 2,000 in first 60 days, then get 2,00 bonus reward points

- You can get an annual fees reversal when spends Rs 90,000 and above

- Across all petrol pumps for transactions between Rs 500 to Rs 3,000 and have 1% fuel surcharge waiver

- You have to pay an annual fee Rs 499 for one-time

- Renewal fee Rs 499 per annum

If you are attracted with features of SimplySAVE SBI card, then login now official site and apply. You can follow the steps and step in for this product.

Apply Online For SBI SimplySAVE Card

- Visit the official site of SBI

- Fill your personal and professional details

- Upload your KYC with passport size photograph

- Share registered email ID and mobile number

- Finally, click on submit button

What Are The Requirement Of The SBI Credit Card?

For all kind of financial help, the lenders can ask few things which you can match online from anywhere. It’s an Age eligibility and KYC factor. Before you can prepare yourself to get any financial support from the bank, should aware small things.

Age Eligibility For SimplySAVE

- For salaried or self-employed, should be between 21 to 70 years

- For pensioner 40 to 70 years

- A spotless credit history

KYC Factor For SBI Card

- Identity proof

- Address proof

- Income proof

- Recent passport size photograph

How Can You Use Your SBI Credit Card For Multiple Purpose?

The bank can provide you various privileges you can pick any of them and enjoy with SimplySAVE SBI credit card.

Payment Method

You can have two options an online and offline. You can select any and make SBI credit card payment on-time. Follow steps

- Visit the official site of the bank

- Enter your personal or professional details

- Upload KYC with passport size photograp

After that, avail to use many online services such as net banking, autopay, RTGS and more.

For an offline, visit the nearest bank branch and pay bills by cash or cheque.

The Bank Statement

It’s like a tracker of your card, which can capture all swipe report. After the completed one-month billing cycle, the bank can send a mail to your registered email ID. You can check expenses, swipe report, the limit, etc.

SBI Customer Care Service

Call on 1860 180 1290 and take a prompt response. You can ask questions, share feedback or complaints. The executives are in your service by 24*7, to give a quick solution.